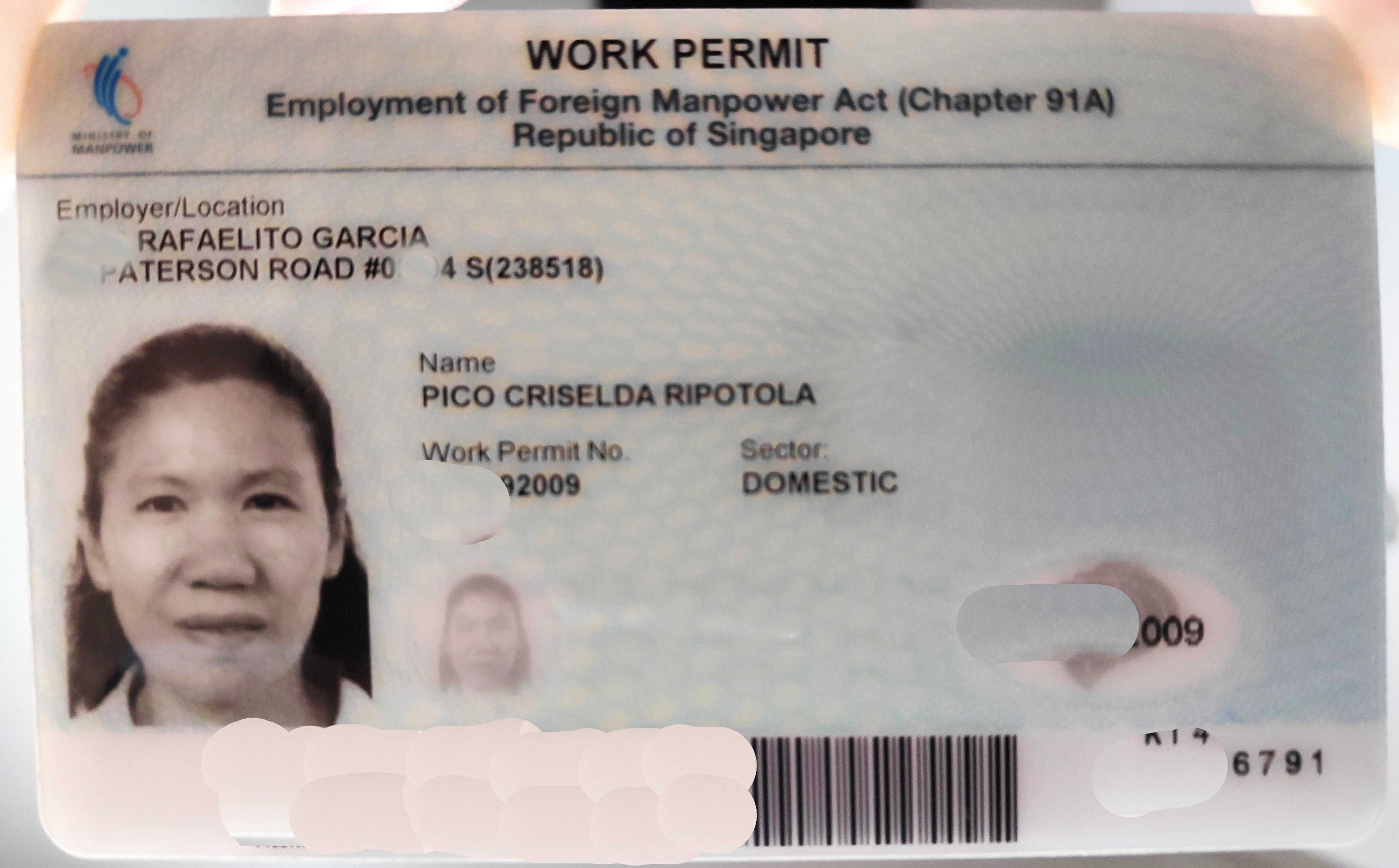

Criselda Ripotola Pico 'Cris' was born on 14-03-1970 in the Philippines and came to work in Singapore as a domestic helper (or maid) where we met on a bus ride in 2010 and became good friends whilst I worked as a research scientist in beautiful, safe, well-run Singapore. This document is written as a simple historical record and as a warning to others to avoid any situation of work, contract or finance interacting with Criselda Pico whom I have discovered is not of good character.

Cris has had a few addresses in Singapore and The Philippines as shown below:

I trusted Cris and when I left Singapore and put my belongings into storage, I gave Cris the key for my storage locker (but not the numeric access code). Cris worked hard in Singapore and told me of her successes: that her daughter was nearly finished university training as a dentist, and that she owned, or was buying, five properties back in The Philippines. Unfortunately, Cris was kind, trusting and her relative financial success meant that she would occasionally lend money to other Philippines OFW (overseas workers) in Singapore and they occasionally disappeared and failed to repay their loans to Cris.

I left Singapore in 2011 but I stayed in contact with Cris via email and when, in 2019, Cris explained that she had run into cash-flow problems related to her daughter needing to retake a year at university and the difficulties around selling her properties quickly back home in the Philippines, she asked if I could give her a short-term unsecured loan for 6-months and we established that it would be a formal loan contract with signatures, ID, personal details, an end date and an initial electronic bank transfer were used to ensure that there was complete clarity about the amounts, dates, interest-rate etc. on an explicit loan agreement.

The initial amount was GBP 2000 and I was careful but not especially anxious because I expected to be able to get my money back soon, with thanks an interest payment and I would also be helping an old friend with a temporary cash flow problem and her daughter's education. Furthermore, the famously law-abiding nature of Singapore and it's efficient Police and Justice systems and Cris's precarious position as a guest worker meant that Cris would be in a risky position if she ever defaulted or broke any laws. Cris then asked for a further loan to enable her to finish her previous investments in two Filinvest properties which would then "Turn-over" and become properties available for rent in Manilla (they were generating no rental income until they "turned-over" to the customer).

Then in late 2019, Chinese authorities failed to contain the initial SARS-CoV-2 pandemic and many hospitals kept sick infected patients alive turning them into virus mutation, incubation and growth factories and then stupid governments (not Sweden) imagined somehow that horrific lockdowns would stop the virus infections or help businesses and, sadly, Singapore which is a famously open, international, archetypal entrepot city foolishly tried lockdowns too and Cris lost freedoms and income which troubled me especially as a friend, microbiologist and global investor so Cris asked for a final loan and reassured me that all would be gratefully repaid as soon as she was working again. Singapore maids sometimes take extra casual work outside their host family home though this might have been illegal and was actually sensibly stopped during the lockdowns.

To assist Cris, I reduced the loan interest rate from 12% per annum to 10% after the first year especially to support her during the long damaging lockdown period. To further attempt to avoid her losing so much, I ignored all the penalty clauses and gave her more time to repay and then I offered to defer part of the loan repayments and interest payments if she just repaid half of the loan but she never repaid anything! I feel compelled to prepare this document as a warning to others never to trust Criselda Pico or others like her.

Remember the old proverb that 'A fool and his money are soon parted'.

| Singapore Debt Collection Service | |